Introduction

Invoice processing has historically been slow, error-prone, and expensive. In 2025, businesses are shifting to AI-powered automation to extract, review, and manage financial data with unmatched accuracy. Whether you're a small business, an accountant, or an enterprise finance team, AI can dramatically reduce manual efforts and operational costs.

In this article, we explore how AI transforms invoice processing—and why thousands of companies are replacing manual data entry with automation.

Why Invoice Processing Needed a Transformation

Traditional invoice processing involved:

Manually entering values into Excel or accounting tools

Checking line items one by one

Matching purchase orders with invoices

Validating tax totals

Searching and filing documents

This leads to:

Human errors

Delays in payments

Lost or misfiled invoices

Higher operational costs

Scaling problems

Poor visibility into spending

AI solves these challenges at scale.

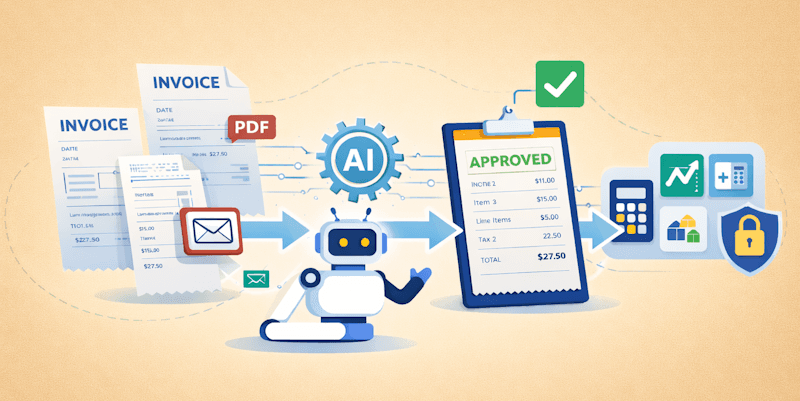

How AI-Powered Invoice Processing Works

Modern systems use a combination of:

1. OCR (Optical Character Recognition)

Identifies text in PDFs, images, and scanned documents.

2. AI Parsing / LLM Processing

Understands meaning, context, and structure—something traditional OCR cannot do.

3. Field Mapping

AI detects and extracts:

Invoice number

Supplier details

Dates

Subtotals, taxes, totals

Line items

Payment details

4. Validation Rules

AI verifies:

Mathematical correctness

Missing fields

Tax inconsistencies

5. Categorisation & Insights

AI automatically assigns categories such as:

Travel

Meals & Entertainment

Office Expenses

Software Subscriptions

Repairs & Services

This enables businesses to instantly understand their spending patterns.

Benefits of AI Invoice Processing in 2025

1. 10× Faster Processing

Invoices that took minutes can now be processed in seconds.

2. Up to 95–99% Accuracy

LLMs reduce human errors significantly.

3. No Manual Data Entry

Zero typing, fewer mistakes, better efficiency.

4. Supports All Document Types

PDFs

Photos of receipts

Scanned invoices

Multi-page documents

Mixed-quality images

5. Instant Categorisation

AI automatically detects categories to assist with accounting and reporting.

6. Workflow Automation

With approval flows, businesses can:

Assign reviewers

Approve or reject invoices

Add comments

Track audit history

7. Export-Ready Data

Data can be exported instantly in CSV, Excel, PDF, and JSON formats.

Real-World Example

A growing e-commerce business receives 400+ invoices per month.

Before AI:

20–25 hours of manual entry

Delays in payment

Limited visibility into expenses

After AI:

Processing time reduced to < 1 hour

Instant insights into spending

Faster approvals

Zero data-entry fatigue

How DocuNero Helps

DocuNero automates your entire invoice workflow:

⏱ Upload → process in seconds

📄 Extracts structured data (fields + line items)

🧠 Categorises spending

🔎 Approval workflow for teams

📤 Export to CSV, Excel, JSON, PDF

📚 Organise & search across all documents

Whether you manage 50 invoices or 50,000, DocuNero scales with your needs.

Try DocuNero for Free

Conclusion

AI is no longer optional—it is a competitive advantage. In 2025, companies that automate invoice processing save time, reduce costs, and make smarter financial decisions. Transitioning from manual workflows to AI-powered systems unlocks efficiency and accuracy that traditional methods simply cannot achieve.