Automating Accounts Payable With AI: A Step-by-Step Workflow

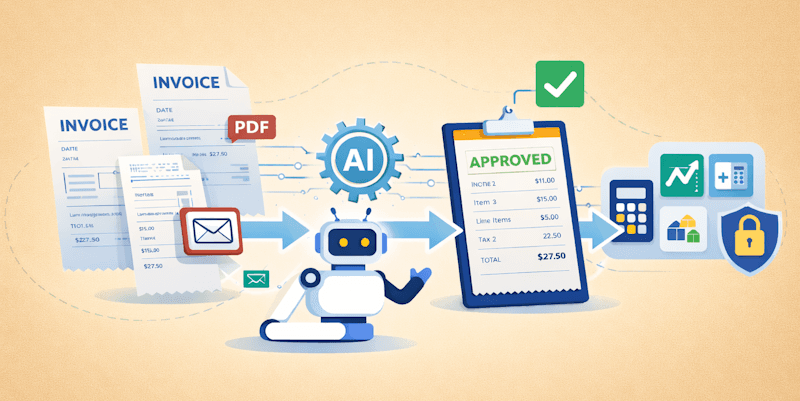

Accounts payable automation with AI helps businesses reduce manual work, improve accuracy, and speed up invoice processing. This guide explains the complete AI-driven AP workflow step by step.

Introduction

Accounts payable (AP) is one of the most critical finance functions in any business. It ensures vendors are paid on time, records are accurate, and financial operations run smoothly. However, traditional AP processes are often manual, slow, and error-prone.

AI-powered automation is transforming accounts payable by reducing data entry, improving accuracy, and accelerating invoice processing. Instead of spending hours handling invoices manually, finance teams can rely on intelligent workflows that work at scale.

In this guide, we’ll walk through a step-by-step AI-powered accounts payable workflow and explain how modern businesses are automating AP end to end.

What Is Accounts Payable Automation?

Accounts payable automation is the use of technology to streamline and automate tasks such as:

Invoice capture

Data extraction

Validation and approval

Payment preparation

Record keeping

When AI is added to the process, the system can understand documents, validate data, and adapt to different invoice formats automatically.

Why Manual Accounts Payable Processes Fail

Before automation, most AP teams struggle with:

Manual invoice data entry

Paper and email-based approvals

Duplicate or missing invoices

Late payments and vendor disputes

Limited visibility into AP status

As invoice volume grows, these problems scale quickly and impact cash flow and compliance.

How AI Transforms Accounts Payable

AI changes AP by:

Understanding invoice layouts and structures

Extracting accurate data from scanned and digital invoices

Validating totals, taxes, and vendor details

Reducing human intervention

This allows AP teams to focus on exceptions rather than routine tasks.

Step-by-Step AI-Powered Accounts Payable Workflow

Step 1: Invoice Collection

Invoices are collected from multiple sources:

Email attachments

Uploaded PDFs

Scanned paper invoices

Vendor portals

AI-powered systems support all common invoice formats without requiring manual preparation.

Step 2: Invoice Data Extraction

AI extracts key invoice fields such as:

Vendor name

Invoice number

Invoice date

Line items

Tax and total amounts

Unlike traditional OCR, AI understands context and structure, resulting in higher accuracy.

Step 3: Line Item & Tax Validation

Extracted data is validated automatically:

Line items are checked against totals

Tax calculations are verified

Missing or inconsistent fields are flagged

This step significantly reduces downstream accounting errors.

Step 4: Duplicate & Fraud Detection

AI systems can detect:

Duplicate invoices

Reused invoice numbers

Unusual amounts or vendors

This adds an extra layer of control and reduces the risk of overpayment or fraud.

Step 5: Approval Workflow

Invoices are routed for approval based on:

Amount thresholds

Vendor rules

Department or cost center

Approvals can be completed digitally, eliminating email chains and paper trails.

Step 6: Export & Accounting Integration

Once approved, invoice data is exported to:

Accounting software

ERP systems

Excel or CSV reports

This ensures clean, structured data flows directly into financial systems.

Step 7: Audit-Ready Storage

Invoices and extracted data are stored securely with:

Searchable records

Linked approvals

Timestamped activity logs

This makes audits and compliance reviews faster and easier.

Benefits of Automating Accounts Payable With AI

1. Faster Invoice Processing

Invoices are processed in minutes instead of days.

2. Improved Accuracy

AI reduces human errors in data entry and validation.

3. Lower Operational Costs

Less manual work means lower processing costs per invoice.

4. Better Cash Flow Visibility

Real-time insights into pending and approved invoices.

How DocuNero Supports Accounts Payable Automation

DocuNero helps businesses automate accounts payable by combining OCR with AI-powered document understanding.

Key capabilities include:

Automated invoice and line-item extraction

Support for scanned and digital invoices

Validation of totals, taxes, and currencies

Batch processing for high invoice volumes

Export-ready structured data

This enables finance teams to build reliable, scalable AP workflows without complex setups.

Try DocuNero for Free - Sign-up now

Who Should Use AI-Based AP Automation?

AI-powered AP automation is ideal for:

Small and mid-sized businesses

Growing finance teams

Accounting firms and bookkeepers

Businesses processing high invoice volumes

Any organization looking to reduce manual AP effort can benefit.

When Is the Right Time to Automate Accounts Payable?

Consider automation if:

Invoice volume is increasing

Manual processing causes delays

Errors impact reporting or payments

AP teams are overwhelmed with repetitive tasks

Early adoption delivers faster ROI and smoother scaling.

Conclusion

Manual accounts payable processes are no longer sustainable for modern businesses. AI-powered AP automation streamlines invoice handling, improves accuracy, and delivers real-time visibility into financial operations.

By following a structured, step-by-step workflow, businesses can transform accounts payable from a bottleneck into an efficient, automated process. Platforms like DocuNero make this transition practical, scalable, and accessible—helping finance teams focus on strategy instead of paperwork.

Ready to get started with DocuNero?

Join thousands of users who trust us to automate their invoices and receipts with AI.

Start Free with DocuNeroAdmin

Admin at DocuNero, helping users simplify invoice and receipt processing through AI-powered automation.

View all posts by AdminRelated Posts

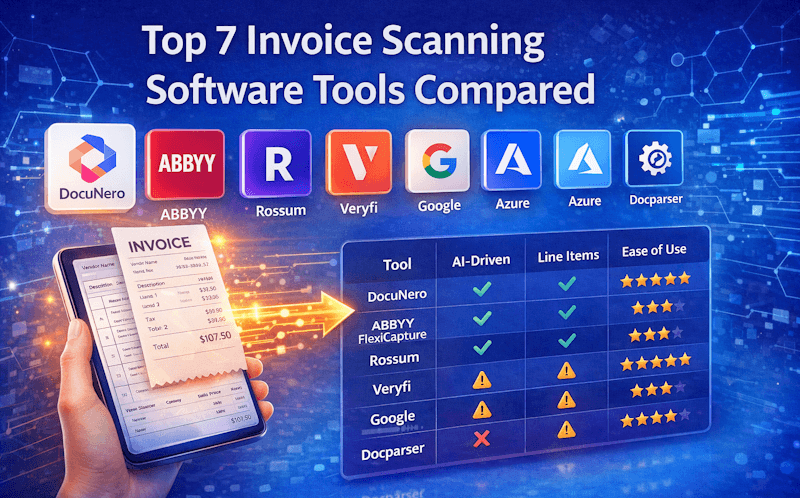

Top 7 Invoice Scanning Software Tools Compared (2026)

Looking for the best invoice scanning software in 2026? We compare accuracy, features, pricing, and use cases across the top 7 invoice OCR and AI tools.

How AI Is Transforming Invoice Processing in 2025: A Complete Guide

AI is reshaping how businesses manage invoices by eliminating manual data entry, reducing errors, and delivering faster, more accurate financial processing. In 2025, modern AI systems extract key fields, categorize expenses, validate totals, and streamline approval workflows—all in seconds. Learn how AI-powered automation helps businesses save time, cut costs, and gain real-time visibility into financial data.