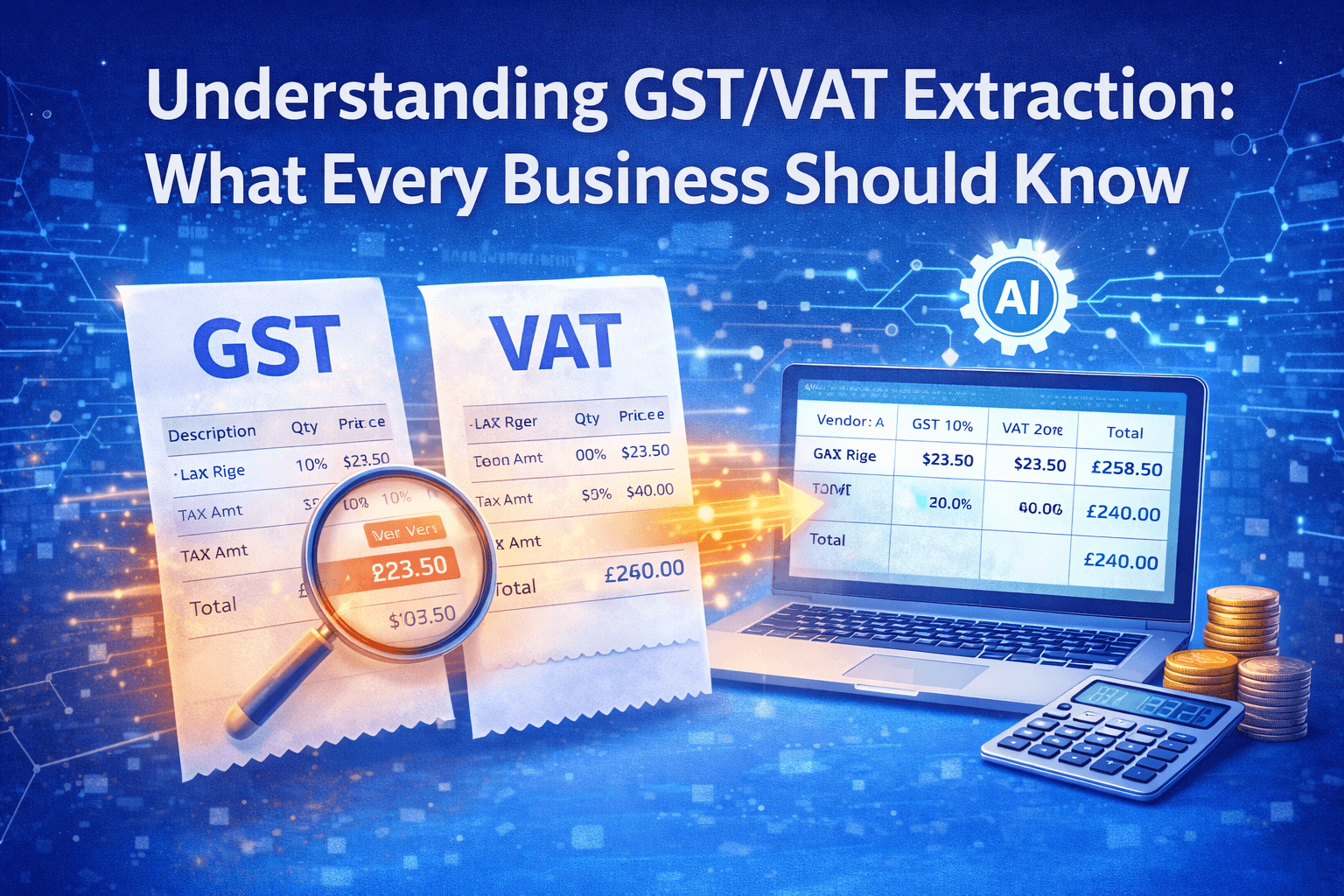

Understanding GST/VAT Extraction: What Every Business Should Know

GST and VAT extraction is critical for accurate tax reporting and compliance. Learn how it works, common challenges, and how automation improves accuracy.

Introduction

Taxes like GST (Goods and Services Tax) and VAT (Value Added Tax) are a fundamental part of business transactions worldwide. Every invoice typically includes tax amounts that must be recorded accurately for reporting, reconciliation, and compliance.

However, extracting GST or VAT data manually from invoices is often time-consuming and error-prone—especially when dealing with high invoice volumes or multiple tax rates.

This guide explains what GST/VAT extraction is, why it matters, common challenges businesses face, and how modern automation simplifies the process.

What Is GST/VAT Extraction?

GST/VAT extraction is the process of identifying and capturing tax-related information from invoices, such as:

Taxable amount

GST or VAT rate

Tax amount

Total amount including tax

This data is essential for:

Tax filings

Expense reconciliation

Audit readiness

Financial reporting

Accurate extraction ensures businesses neither underpay nor overpay taxes.

Why Accurate GST/VAT Extraction Matters

1. Tax Compliance

Incorrect tax data can lead to:

Filing errors

Penalties and fines

Audit risks

Accurate extraction helps ensure compliance with local tax regulations.

2. Financial Accuracy

GST/VAT directly affects:

Profit and loss statements

Expense categorization

Cash flow tracking

Even small errors can add up over time.

3. Audit Readiness

Auditors often require:

Proof of tax amounts

Supporting invoices

Clear breakdowns of taxable vs non-taxable items

Digitally extracted and stored tax data simplifies audits significantly.

Common Challenges With Manual GST/VAT Extraction

Businesses relying on manual processes often face:

Inconsistent invoice formats

Multiple tax rates on a single invoice

Missing or unclear tax labels

Human data-entry errors

Difficulty handling international invoices

These challenges increase as invoice volumes grow.

How GST/VAT Appears on Invoices

GST/VAT information may appear in different ways depending on the region and vendor:

As a single tax line

As line-item-level tax

As multiple tax components

Embedded in totals

This variation makes rule-based extraction difficult.

Traditional OCR vs AI-Based Tax Extraction

Traditional OCR

Reads text only

Cannot reliably identify tax fields

Struggles with layout variations

AI-Based Extraction

Understands invoice structure

Identifies tax labels and values

Validates totals and tax calculations

Handles multiple formats and currencies

AI-based systems significantly improve tax extraction accuracy.

How Automation Improves GST/VAT Accuracy

Automation helps by:

Detecting tax sections automatically

Cross-checking tax totals against line items

Identifying missing or inconsistent values

Reducing manual review time

This results in faster processing and fewer errors.

How DocuNero Handles GST/VAT Extraction

DocuNero uses AI-powered document understanding to extract GST and VAT data accurately from invoices.

Key capabilities include:

Automatic detection of tax fields

Support for multiple tax rates

Validation against invoice totals

Structured tax data ready for export

Compatibility with scanned and digital invoices

This helps businesses maintain accurate tax records without manual effort.

Who Benefits Most From Automated GST/VAT Extraction?

Automated tax extraction is especially useful for:

Small and medium businesses

Accounting and finance teams

Companies with high invoice volumes

Businesses operating across regions

Any organization aiming to reduce tax-related errors benefits from automation.

Best Practices for GST/VAT Management

Digitize invoices as early as possible

Review extracted tax data periodically

Store invoices and tax records securely

Use tools that support regional tax rules

Maintain clear audit trails

These practices help ensure long-term compliance and efficiency.

When Should Businesses Automate GST/VAT Extraction?

Consider automation if:

Manual tax entry causes delays

Errors are discovered during reconciliation

Invoice volumes are increasing

Tax reporting feels stressful or inconsistent

Automation becomes more valuable as businesses scale.

Conclusion

GST/VAT extraction is a critical part of financial operations, yet it remains a common source of errors when handled manually. With varying invoice formats, tax rates, and regulations, businesses need more than basic OCR to stay compliant.

AI-powered extraction simplifies this process by improving accuracy, reducing manual work, and ensuring audit readiness. By adopting automated solutions, businesses can manage tax data confidently and focus on growth rather than paperwork.

Ready to get started with DocuNero?

Join thousands of users who trust us to automate their invoices and receipts with AI.

Start Free with DocuNeroAdmin

Admin at DocuNero, helping users simplify invoice and receipt processing through AI-powered automation.

View all posts by AdminRelated Posts

How to Extract Line Items From Invoices Automatically (Using AI)

Manually extracting invoice line items is slow and error-prone. Learn how AI automatically captures quantities, prices, taxes, and totals—accurately and at scale.

OCR vs Manual Data Entry: Accuracy, Speed & Cost Comparison (2025 Edition)

Manual data entry is slow, expensive, and error-prone. This guide compares manual work with modern OCR + AI automation to show which method wins in 2025.